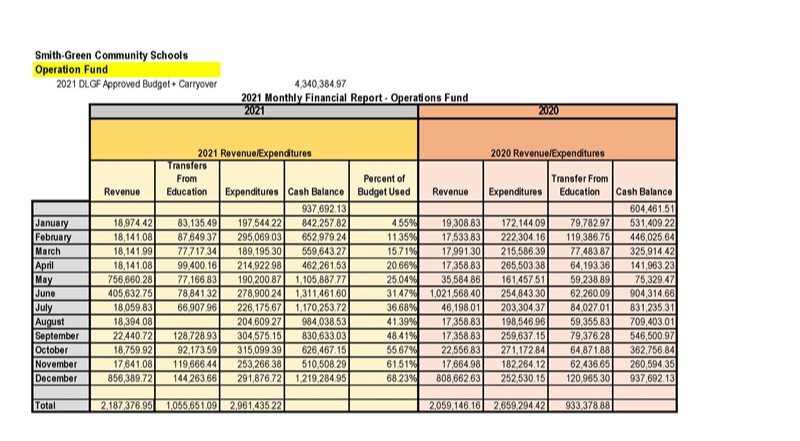

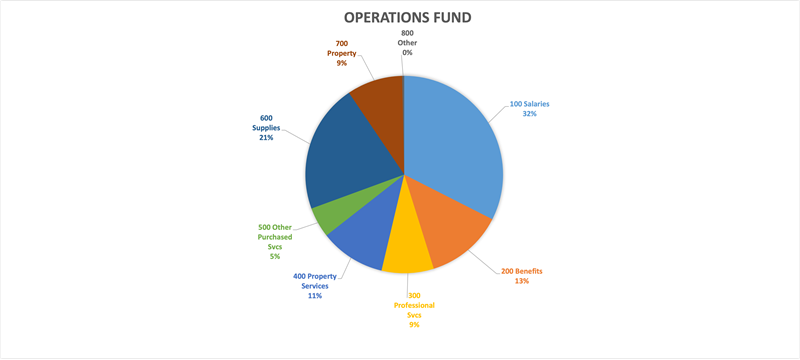

Operation Fund

The Operations Fund is generated from local property tax funding. Prior to 2019, each school corporation had three separate tax rates for Capital Projects, Transportation, and Bus Replacement. Starting in 2019, all of these tax levies were combined into the current Operations Funds, and the allowable expenditures were adjusted. The tax rate for the Operations Fund is regulated through the Department of Local Government Finance and the budget process. Currently, the Operations Fund can be used to pay for capital projects, transportation, and any expenses related to overhead and operational expenditures. Transfers between the Education and Operations Funds are now permitted; however, there is an expected limit of less than 15% when funds are moved from the Education Fund to the Operations Fund.

Below, please find specific revenue and expenditure data for SGCS